Allstate Auto Insurance: Your Comprehensive Guide To Coverage And Savings

When it comes to protecting your vehicle, Allstate auto insurance stands out as one of the top choices for millions of drivers across the United States. With a reputation built on trust, reliability, and competitive pricing, Allstate has earned its place as a leader in the insurance industry. Whether you're a new driver or a seasoned motorist, understanding how Allstate auto insurance works can help you make smarter decisions about your coverage.

Driving a car is both a privilege and a responsibility. While owning a vehicle offers convenience and freedom, it also comes with risks that require proper protection. This is where Allstate steps in. Their comprehensive range of policies ensures that you're covered no matter what happens on the road. From minor accidents to major collisions, Allstate has got your back.

But why choose Allstate? Well, let me break it down for you. Allstate isn't just another insurance company; it's a brand that understands the unique needs of modern drivers. With innovative tools, personalized service, and a network of over 12,000 agents nationwide, they provide more than just insurance—they offer peace of mind.

- Unlock The Power Of Telegram Mms Channels Your Ultimate Guide

- Hdhub4u Ltd Hindi Your Ultimate Destination For Bollywood Entertainment

Understanding Allstate Auto Insurance

Let's dive into the nitty-gritty of Allstate auto insurance. What exactly does it cover, and how does it differ from other providers? First things first, Allstate offers a variety of coverage options tailored to meet your specific needs. Whether you're driving a brand-new Tesla or a trusty old sedan, Allstate has a plan that fits your budget and lifestyle.

What Does Allstate Auto Insurance Cover?

Here’s a quick rundown of the key coverages offered by Allstate:

- Liability Coverage: Protects you if you're found at fault in an accident, covering damages to other vehicles or property.

- Collision Coverage: Covers repairs or replacement costs for your own vehicle in case of a collision.

- Comprehensive Coverage: Provides protection against non-collision incidents like theft, vandalism, or natural disasters.

- Medical Payments Coverage: Helps cover medical expenses for you and your passengers in the event of an accident.

- Rental Reimbursement: Covers the cost of renting a car while yours is being repaired.

These are just a few examples of the many coverage options available through Allstate. The best part? You can customize your policy to include only the protections you need.

- Bollywood Hd Movies Free Download Your Ultimate Guide To Legal Streaming

- Why Filmywap Hollywood Movies In Hindi Download Is Trending Among Movie Lovers

Why Choose Allstate for Your Auto Insurance Needs?

With so many insurance companies out there, why should you pick Allstate? Here's why:

- Customer Service: Allstate boasts a team of dedicated agents who are always ready to assist you, whether it's answering questions or filing claims.

- Technology: Their mobile app and online tools make managing your policy a breeze. From paying premiums to filing claims, everything can be done with just a few taps on your phone.

- Financial Stability: Allstate is one of the largest insurance providers in the U.S., ensuring that your policy is backed by a financially stable company.

Plus, Allstate continuously invests in cutting-edge technology to enhance the customer experience. For example, their Drivewise program uses telematics to monitor your driving habits and reward safe drivers with discounts.

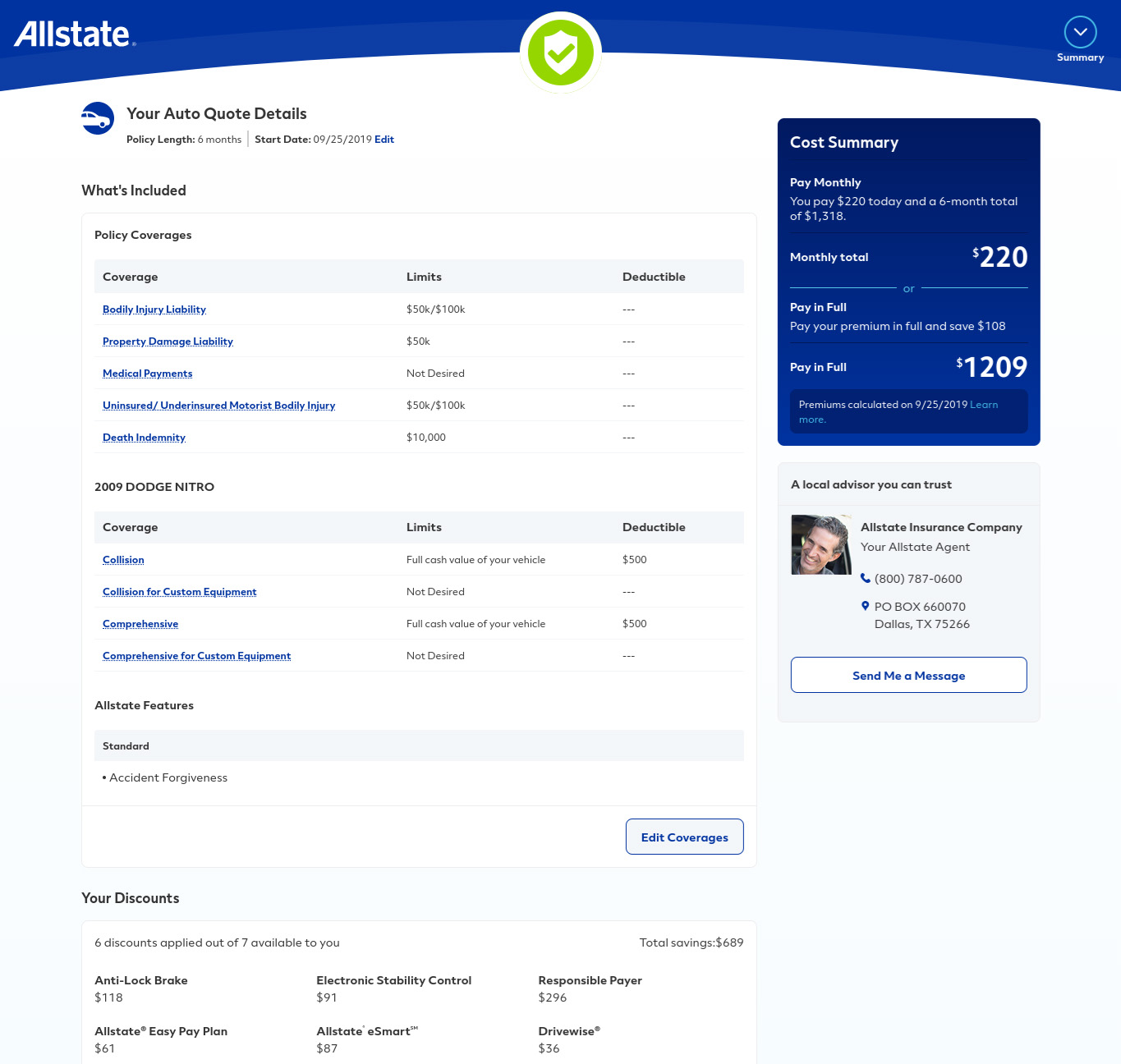

How Much Does Allstate Auto Insurance Cost?

Cost is always a major consideration when choosing an insurance provider. So, how much can you expect to pay for Allstate auto insurance? The truth is, premiums vary based on several factors, including:

- Your age and driving history

- The type of vehicle you drive

- Your location

- The level of coverage you select

That said, Allstate is known for offering competitive rates without compromising on quality. Plus, they frequently run promotions and offer discounts to help you save even more.

Available Discounts from Allstate

Looking to slash your insurance costs? Allstate offers a range of discounts that could significantly reduce your premiums. Some of these include:

- Safe Driver Discount: Reward for maintaining a clean driving record.

- Multi-Car Discount: Save when you insure multiple vehicles under the same policy.

- Good Student Discount: Offered to students who maintain good grades.

- Drivewise Discount: Earn discounts based on your safe driving habits.

By taking advantage of these discounts, you can enjoy substantial savings while still enjoying comprehensive coverage.

How to Get a Quote from Allstate

Ready to see how much Allstate auto insurance could cost you? Getting a quote is easier than ever. Simply visit their website or download their mobile app, and you'll be guided through a simple process that takes just minutes to complete. Alternatively, you can call an Allstate agent directly for personalized assistance.

During the quoting process, you'll be asked to provide some basic information, such as:

- Your personal details (name, address, etc.)

- Vehicle information (make, model, year)

- Your driving history

Once you've submitted this information, Allstate will generate a customized quote based on your needs and preferences.

What Customers Say About Allstate

Word of mouth matters, especially when it comes to something as important as insurance. So, what do Allstate customers have to say about their experience? Overall, reviews are overwhelmingly positive. Many praise Allstate for its exceptional customer service, quick claims processing, and affordable rates.

Of course, like any company, Allstate isn't perfect. Some customers have expressed concerns about premium increases after filing claims. However, most agree that the benefits outweigh the drawbacks, making Allstate a solid choice for auto insurance.

Common Questions About Allstate Auto Insurance

Still have questions? Here are answers to some of the most frequently asked questions about Allstate auto insurance:

- Is Allstate reliable? Absolutely. Allstate has been serving customers for over 80 years and is consistently ranked among the top insurance providers in the U.S.

- Does Allstate cover rental cars? Yes, if you add rental reimbursement coverage to your policy.

- How long does it take to process a claim? Allstate aims to process claims quickly, often within days of submission.

These FAQs should give you a better understanding of what to expect when working with Allstate.

Comparing Allstate to Other Providers

Before committing to Allstate, it's worth comparing them to other major insurance providers. While each company has its strengths, Allstate stands out for its combination of affordability, technology, and customer service. For instance:

- GEICO: Known for its low rates but may lack the personalized service offered by Allstate.

- State Farm: Offers similar coverage options but tends to be slightly more expensive than Allstate.

- Progressive: Great for budget-conscious drivers but doesn't always match Allstate's technological innovations.

Ultimately, the best provider for you will depend on your individual needs and priorities.

Tips for Maximizing Your Allstate Auto Insurance Policy

Now that you know the ins and outs of Allstate auto insurance, here are a few tips to help you get the most out of your policy:

- Review your policy annually to ensure it still meets your needs.

- Take advantage of available discounts to lower your premiums.

- Stay informed about new offerings or promotions from Allstate.

- Keep a record of all communications with Allstate for future reference.

By following these tips, you can ensure that you're getting the best value from your Allstate auto insurance policy.

Conclusion: Why Allstate Auto Insurance Is Worth It

In conclusion, Allstate auto insurance offers a winning combination of affordability, reliability, and innovation. Whether you're a first-time driver or a seasoned motorist, Allstate has a policy that fits your unique needs. With customizable coverage options, competitive rates, and exceptional customer service, Allstate truly sets the standard for auto insurance.

So, what are you waiting for? Take the first step toward protecting yourself and your vehicle by getting a quote from Allstate today. And don't forget to share this article with friends and family who might benefit from the information. Together, let's make the road a safer place for everyone!

Table of Contents

- Understanding Allstate Auto Insurance

- Why Choose Allstate for Your Auto Insurance Needs?

- How Much Does Allstate Auto Insurance Cost?

- How to Get a Quote from Allstate

- What Customers Say About Allstate

- Comparing Allstate to Other Providers

- Tips for Maximizing Your Allstate Auto Insurance Policy

Detail Author:

- Name : Maybell Kozey

- Username : udooley

- Email : stanton.camille@yahoo.com

- Birthdate : 2001-04-04

- Address : 666 Dorothy Cliff Suite 941 South Luis, NY 92045

- Phone : +1-769-673-4990

- Company : Russel, Witting and Murphy

- Job : Sales Person

- Bio : Voluptatem et officiis eaque non distinctio. Ipsum corrupti facilis sit harum debitis. Sapiente odio voluptate illo quam. Suscipit sit optio voluptatibus dicta ipsa.

Socials

linkedin:

- url : https://linkedin.com/in/jbatz

- username : jbatz

- bio : Totam laborum qui eaque aut placeat.

- followers : 4937

- following : 858

tiktok:

- url : https://tiktok.com/@jamar9051

- username : jamar9051

- bio : Ea quidem deserunt totam eligendi fugit eaque.

- followers : 6842

- following : 195