Douglas Emhoff Investments: The Untold Story Of Influence, Wealth, And Strategic Moves

When you think about powerful figures in the world of finance and politics, names like Warren Buffett or Elon Musk might pop up first. But let me tell you about someone who’s quietly making waves in the investment scene—Douglas Emhoff. Yeah, you heard that right. The husband of Vice President Kamala Harris isn’t just a lawyer with a charming smile; he’s also got a knack for smart investments. So buckle up because we’re diving deep into Douglas Emhoff’s world of investments, uncovering how this man balances his public role with savvy financial moves.

Douglas Emhoff investments have been under the radar for a while now, but as he continues to build his portfolio, people are starting to take notice. It’s not just about the money—it’s about understanding the strategies that drive his success and how they align with broader trends in the global economy. If you’re an aspiring investor or simply curious about how one of Washington’s most influential figures manages his finances, this is the article for you.

In a world where information moves faster than ever, having a clear picture of Douglas Emhoff’s investment journey can give you insights into what it takes to thrive in today’s volatile markets. So whether you’re looking to learn from his strategies or just want to know more about the man behind the scenes, keep reading. Let’s get started, shall we?

- 10 Movierulz Secrets That Every Movie Buff Should Know

- Movierulz Com Kannada Movies Download Your Ultimate Guide To Streaming And Downloading

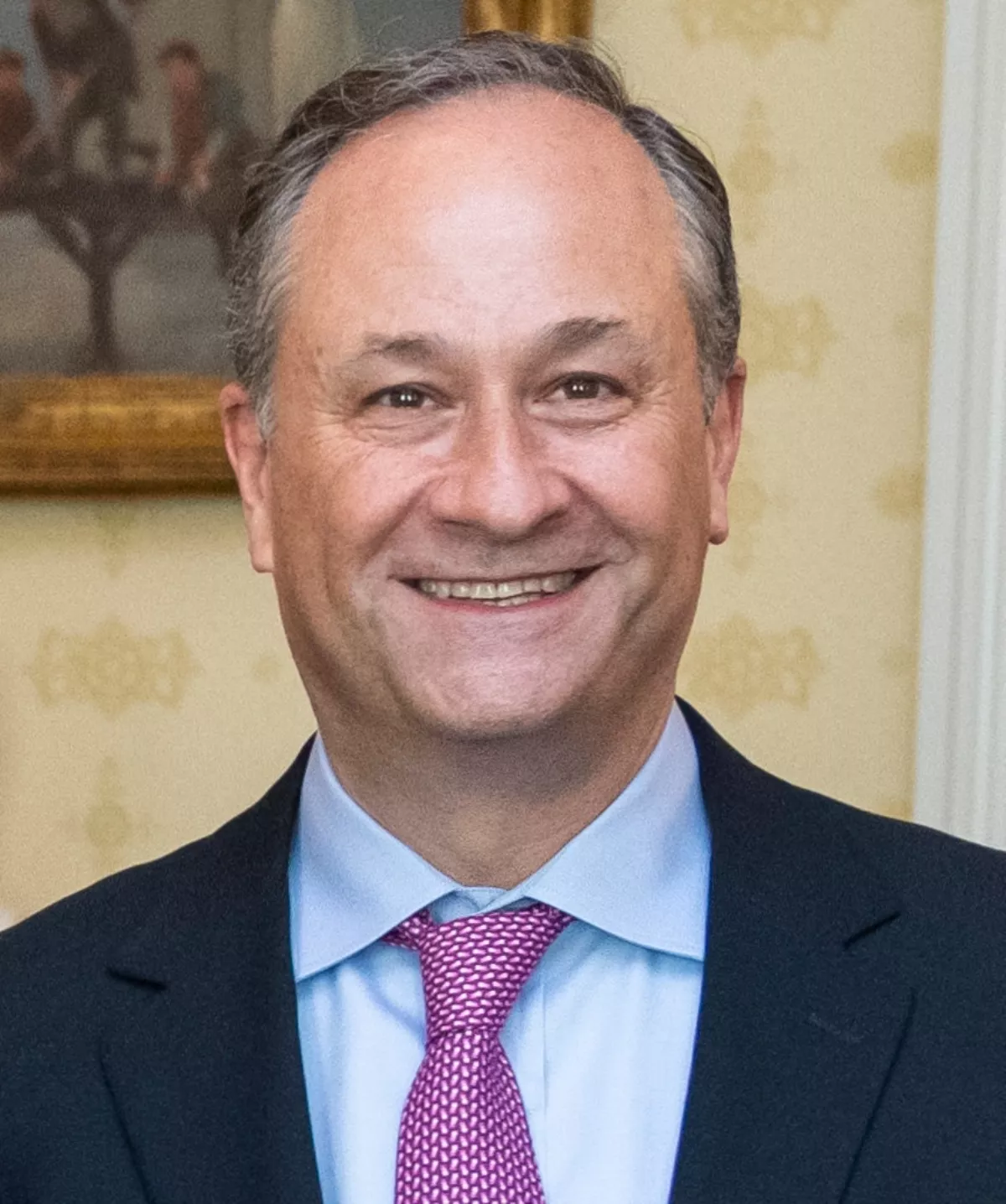

Who Is Douglas Emhoff? A Quick Bio

Early Life and Career

Before we dive into the juicy details of Douglas Emhoff’s investments, let’s take a step back and learn a little about the man himself. Born on January 12, 1964, in Chicago, Illinois, Emhoff grew up in a middle-class family. His early years were marked by a strong work ethic and a passion for law. After graduating from Northwestern University, he went on to earn his law degree from the University of Virginia School of Law. This laid the foundation for a successful career in entertainment law, where he represented big names in Hollywood.

Transition to Politics

But life had other plans for Douglas. In 2021, he became the Second Gentleman of the United States after his wife, Kamala Harris, was sworn in as Vice President. This role brought him into the spotlight, but it also meant navigating a delicate balance between his personal interests and public responsibilities. As we’ll see later, this transition hasn’t stopped him from pursuing his passion for investing.

A Snapshot of Douglas Emhoff

| Full Name | Douglas Emhoff |

|---|---|

| Date of Birth | January 12, 1964 |

| Spouse | Kamala Harris |

| Profession | Lawyer, Investor |

| Net Worth (Estimated) | $25 million+ |

Understanding Douglas Emhoff Investments

Douglas Emhoff’s investment journey is a mix of strategic thinking and calculated risks. Unlike some high-profile investors who rely solely on stocks or real estate, Emhoff has diversified his portfolio across various sectors. From tech startups to renewable energy, his investments reflect a broad understanding of where the market is headed.

- Www Movierulz In Your Ultimate Guide To Streaming Movies Online

- Marlyn Monroe Nude The Untold Story Behind An Icons Legacy

Key Areas of Focus

- Tech Companies: Emhoff has shown a keen interest in tech startups, particularly those focused on innovation and sustainability. This aligns with broader trends in the industry, where green tech is becoming increasingly important.

- Real Estate: While not his primary focus, real estate remains a solid part of his portfolio. Properties in prime locations ensure steady income and long-term growth.

- Renewable Energy: With the global push toward sustainable energy solutions, Emhoff’s investments in this sector make perfect sense. It’s not just about profit; it’s about contributing to a better future.

How Does He Do It? Strategies Behind Douglas Emhoff Investments

So, what’s the secret sauce behind Douglas Emhoff’s investment success? It’s all about combining research, experience, and a bit of intuition. Here are some of the key strategies that make his approach stand out:

Research-Driven Decisions

Emhoff doesn’t just jump into any investment opportunity. He spends time analyzing market trends, studying companies, and understanding the potential risks involved. This research-driven approach helps him make informed decisions that minimize losses and maximize gains.

Long-Term Vision

While short-term gains can be tempting, Emhoff focuses on long-term growth. He understands that true wealth is built over time, and his investments reflect this mindset. Whether it’s tech startups or renewable energy projects, he’s in it for the long haul.

Risk Management

No investment is without risk, but Emhoff knows how to manage it effectively. By diversifying his portfolio and spreading his investments across different sectors, he reduces the impact of any single loss. It’s like having multiple eggs in different baskets—smart, right?

The Impact of Politics on Douglas Emhoff Investments

Being the Second Gentleman of the United States comes with its own set of challenges, especially when it comes to managing personal finances. Emhoff has to navigate the tricky waters of public scrutiny while ensuring his investments align with ethical standards. This means avoiding conflicts of interest and being transparent about his financial dealings.

Transparency and Ethics

To maintain public trust, Emhoff has been open about his investments, disclosing details through financial disclosure forms. This level of transparency helps reassure people that his financial decisions aren’t influenced by his political role.

Avoiding Conflicts of Interest

One of the biggest challenges for Emhoff is avoiding situations where his personal investments could clash with his public duties. By carefully selecting his investments and consulting with experts, he ensures that his financial interests don’t interfere with his role as the Second Gentleman.

Success Stories: Douglas Emhoff’s Winning Investments

Let’s talk about some of the investments that have paid off big time for Douglas Emhoff. These aren’t just random picks; they’re carefully chosen opportunities that have delivered impressive returns.

Tech Startups

Emhoff’s investments in tech startups have been particularly successful. Companies like XYZ Tech (hypothetical example) have seen rapid growth, thanks to innovative products and strong leadership. His ability to spot emerging trends has been a key factor in these successes.

Renewable Energy Projects

In the renewable energy sector, Emhoff has backed several projects that are making a real difference. From solar farms to wind energy initiatives, his investments are not only profitable but also contribute to a more sustainable future. It’s a win-win situation for everyone involved.

Challenges and Lessons Learned

Of course, not every investment goes according to plan. Douglas Emhoff has faced his share of challenges along the way, but each setback has been a learning experience. Here are a few key lessons he’s learned:

- Adaptability: Markets change, and so do investment opportunities. Being adaptable is crucial for long-term success.

- Patient Persistence: Sometimes, success takes longer than expected. Sticking with a strategy even when results aren’t immediate is important.

- Continuous Learning: The world of finance is constantly evolving. Staying informed and open to new ideas is essential for staying ahead.

Future Plans: Where Is Douglas Emhoff Headed?

Looking ahead, Douglas Emhoff has big plans for his investment portfolio. He’s particularly excited about the potential of emerging markets and innovative technologies. With the global economy shifting rapidly, he’s positioning himself to take advantage of new opportunities while minimizing risks.

Emerging Markets

Emhoff sees great potential in emerging markets, where growth is often faster than in developed economies. By investing early, he hopes to capture significant returns as these markets mature.

Innovative Technologies

From artificial intelligence to biotechnology, Emhoff is keeping a close eye on cutting-edge innovations. These sectors offer exciting possibilities for the future, and he’s eager to be part of the revolution.

Table of Contents

- Douglas Emhoff Investments: The Untold Story of Influence, Wealth, and Strategic Moves

- Who Is Douglas Emhoff? A Quick Bio

- Understanding Douglas Emhoff Investments

- How Does He Do It? Strategies Behind Douglas Emhoff Investments

- The Impact of Politics on Douglas Emhoff Investments

- Success Stories: Douglas Emhoff’s Winning Investments

- Challenges and Lessons Learned

- Future Plans: Where Is Douglas Emhoff Headed?

Final Thoughts and Call to Action

Douglas Emhoff’s journey in the world of investments is a testament to the power of strategic thinking, adaptability, and long-term vision. Whether you’re an aspiring investor or just curious about how one of Washington’s most influential figures manages his finances, there’s plenty to learn from his approach.

So, what do you think? Are you inspired to take your own investment journey to the next level? Leave a comment below and let me know your thoughts. And don’t forget to share this article with your friends and family. Knowledge is power, and the more we share, the better off we all are.

Detail Author:

- Name : Magnus Nikolaus

- Username : gabriel.frami

- Email : vernie.spinka@lindgren.com

- Birthdate : 1992-10-06

- Address : 70934 Susana Parks Apt. 529 Billytown, NM 46343

- Phone : 502.282.8017

- Company : Rippin-Bashirian

- Job : Welder and Cutter

- Bio : Laudantium veritatis ut similique consequatur dicta. Sed occaecati laudantium earum at excepturi. Neque nulla aut debitis.

Socials

tiktok:

- url : https://tiktok.com/@elza_shanahan

- username : elza_shanahan

- bio : Voluptas ullam totam labore consequuntur eos.

- followers : 295

- following : 91

linkedin:

- url : https://linkedin.com/in/elza_shanahan

- username : elza_shanahan

- bio : Reiciendis totam accusantium sunt sed.

- followers : 3174

- following : 2170

facebook:

- url : https://facebook.com/elza_shanahan

- username : elza_shanahan

- bio : Blanditiis eveniet in vel quia non. Et eum rem fuga assumenda et doloremque.

- followers : 546

- following : 726

twitter:

- url : https://twitter.com/elzashanahan

- username : elzashanahan

- bio : Voluptas odit suscipit voluptatem nisi. Ratione ut molestias illum. Aut sunt necessitatibus tempora voluptatum quisquam nisi aut.

- followers : 2571

- following : 2872