Allstate Insurance Auto: Your Ultimate Guide To Reliable Car Coverage

When it comes to protecting your vehicle, Allstate insurance auto stands out as one of the most trusted names in the industry. Whether you're a new driver or a seasoned motorist, finding the right car insurance can be overwhelming. But fear not! Allstate has been helping drivers secure their rides for decades. Let's dive into what makes Allstate so special and why it might just be the perfect fit for you.

Picture this: you're cruising down the highway, enjoying the wind in your hair, when suddenly you realize—you need to protect your ride. That's where Allstate steps in. With its comprehensive coverage options and rock-solid reputation, Allstate insurance auto ensures that you're prepared for whatever the road throws your way.

In this article, we'll break down everything you need to know about Allstate insurance auto. From their coverage options to customer service, we'll cover all the bases so you can make an informed decision. So buckle up and let's get started!

- Hollywood Hindi Sex Unveiling The Intersection Of Two Global Film Industries

- Ullu Web Series Watch Free Your Ultimate Guide To Streaming Without Breaking The Bank

Here's a quick glance at what we'll discuss:

- Biography of Allstate Insurance

- Allstate Insurance Auto Coverage Options

- Understanding Allstate Insurance Auto Pricing

- Allstate Customer Service: What to Expect

- The Allstate Claims Process

- Allstate Insurance Auto Discounts

- Real Customer Reviews of Allstate Insurance Auto

- Allstate vs. Competitors

- Tips for Choosing the Right Allstate Insurance Auto Plan

- Frequently Asked Questions About Allstate Insurance Auto

Biography of Allstate Insurance

Before we dive into the nitty-gritty of Allstate insurance auto, let's take a moment to learn about the company itself. Allstate was founded way back in 1931, and since then, it's grown into one of the largest insurance providers in the United States. The company started with a vision to offer affordable, reliable insurance to everyday Americans, and that mission hasn't changed much over the years.

Allstate's headquarters is in Northbrook, Illinois, but its reach extends far beyond the Midwest. With millions of customers across the country, Allstate has established itself as a household name when it comes to insurance. Whether you're looking for auto, home, or life insurance, Allstate has got you covered.

- Why Movierulz Hindi Movie 2025 Is Taking The Film World By Storm

- Unlock The Power Of Telegram Mms Channels Your Ultimate Guide

Key Facts About Allstate Insurance

Here's a quick rundown of some important facts about Allstate:

- Founded: 1931

- Headquarters: Northbrook, Illinois

- Number of Employees: Over 40,000

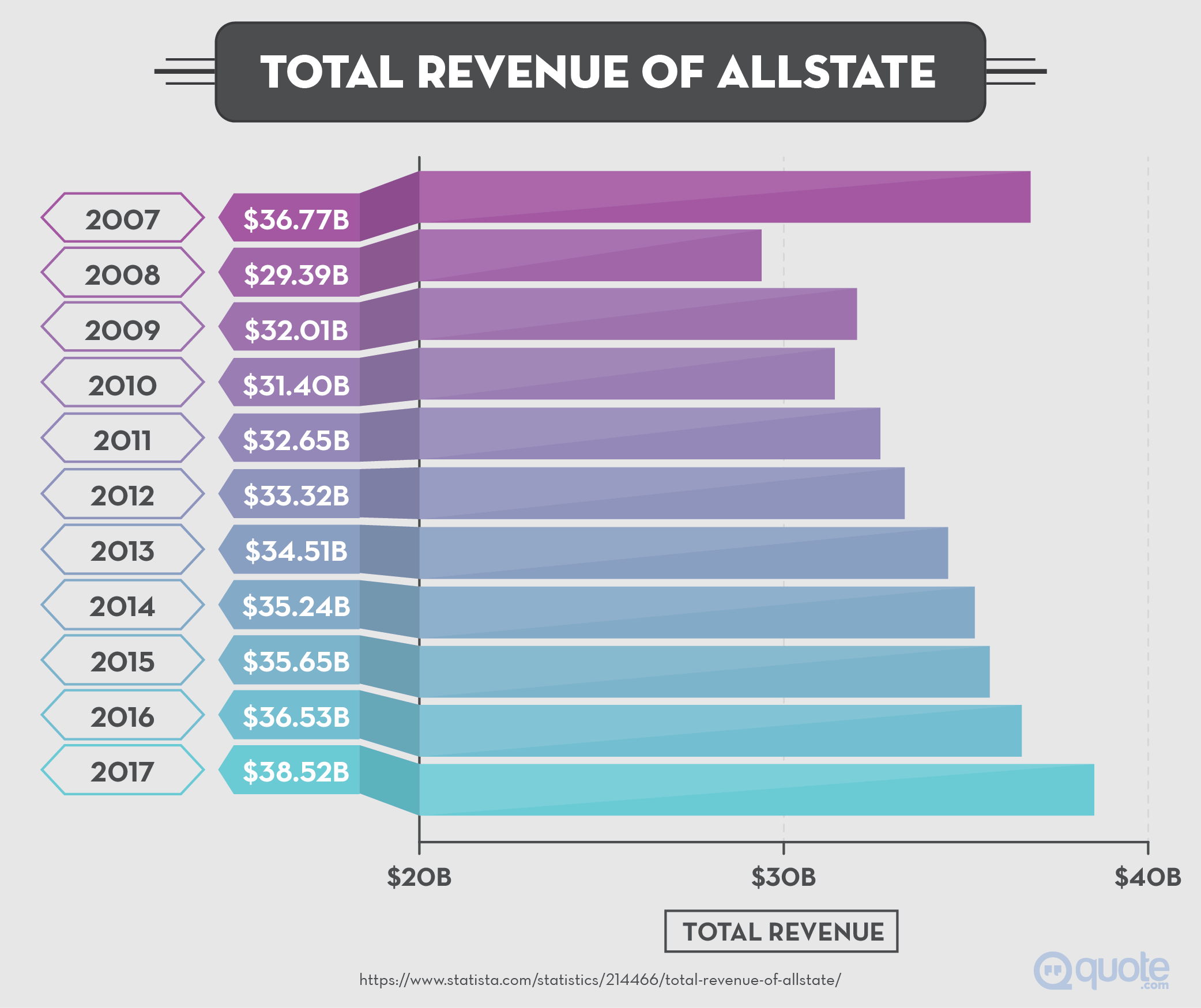

- Annual Revenue: Billions of dollars

- Customers Served: Millions across the U.S.

| Fact | Detail |

|---|---|

| Year Founded | 1931 |

| Headquarters | Northbrook, Illinois |

| Employees | Over 40,000 |

| Annual Revenue | Billions of dollars |

| Customers | Millions across the U.S. |

Allstate Insurance Auto Coverage Options

Alright, let's talk about what really matters—coverage. Allstate insurance auto offers a wide range of coverage options to suit every driver's needs. Whether you're looking for basic liability coverage or comprehensive protection, Allstate has got you covered.

Here are some of the key coverage options you can expect from Allstate:

Liability Coverage

This is the bare minimum coverage required by law in most states. It covers damages or injuries you cause to others in an accident. Allstate offers both bodily injury liability and property damage liability coverage, ensuring you're compliant with state regulations.

Collision Coverage

Collision coverage kicks in when your car is damaged in an accident, regardless of who's at fault. This coverage is especially important if you're driving a newer vehicle or if you're still paying off your car loan.

Comprehensive Coverage

Comprehensive coverage protects your car from non-collision damages, such as theft, vandalism, or natural disasters. It's a great option for drivers who want peace of mind knowing their car is protected from all sorts of mishaps.

Understanding Allstate Insurance Auto Pricing

Pricing is always a big concern when it comes to insurance. So, how much can you expect to pay for Allstate insurance auto? Well, the answer isn't one-size-fits-all. Several factors influence your premium, including your driving record, location, age, and the type of coverage you choose.

According to recent data, the average Allstate insurance auto premium is around $1,500 per year. But don't let that number scare you—many drivers pay significantly less, especially if they qualify for discounts.

Factors That Affect Your Premium

- Driving Record: A clean record can save you big bucks.

- Location: Where you live plays a big role in determining your premium.

- Age and Gender: Younger drivers typically pay more, while women often enjoy lower rates.

- Type of Vehicle: Luxury cars usually cost more to insure.

Allstate Customer Service: What to Expect

Customer service is a crucial aspect of any insurance provider, and Allstate doesn't disappoint in this department. Their customer service team is known for being friendly, knowledgeable, and responsive. Whether you need to file a claim or simply have a question about your policy, Allstate's agents are there to help.

One of the standout features of Allstate's customer service is their 24/7 availability. You can reach them anytime, day or night, via phone, email, or even through their mobile app. Plus, their agents are trained to handle a wide range of issues, ensuring you get the help you need quickly and efficiently.

Ways to Contact Allstate

- Phone: Call their customer service hotline at 1-800-ALLSTATE.

- Email: Send them an email through their website.

- Mobile App: Use the Allstate mobile app for on-the-go assistance.

The Allstate Claims Process

Filing a claim can be stressful, but Allstate aims to make the process as smooth as possible. Their claims process is designed to be quick and efficient, ensuring you get the compensation you deserve without unnecessary delays.

Here's how the Allstate claims process works:

Step-by-Step Guide to Filing a Claim

- Report the Incident: As soon as possible, notify Allstate about the incident.

- Provide Details: Share all relevant information, including photos and police reports if applicable.

- Wait for Assessment: An adjuster will assess the damage and determine the settlement amount.

- Receive Payment: Once the claim is approved, you'll receive your settlement.

Allstate Insurance Auto Discounts

Who doesn't love a good discount? Allstate offers a variety of discounts to help you save money on your car insurance. From safe driver discounts to multi-policy discounts, there are plenty of ways to lower your premium.

Popular Allstate Discounts

- Safe Driver Discount: Reward for maintaining a clean driving record.

- Multi-Policy Discount: Save when you bundle your auto insurance with other policies.

- Good Student Discount: Offered to students with high GPAs.

- Military Discount: A special discount for active military members and veterans.

Real Customer Reviews of Allstate Insurance Auto

What do real customers have to say about Allstate insurance auto? The reviews are generally positive, with many praising Allstate's coverage options, customer service, and claims process. However, like any insurance provider, Allstate isn't perfect, and some customers have expressed concerns about pricing and policy limitations.

According to a recent survey, 85% of Allstate customers would recommend the company to others. That's a pretty impressive statistic, and it speaks volumes about the trust and satisfaction Allstate has built over the years.

Allstate vs. Competitors

How does Allstate stack up against its competitors? Let's take a look at how Allstate compares to other major insurance providers in terms of coverage, pricing, and customer service.

Allstate vs. State Farm

Both Allstate and State Farm are giants in the insurance industry, offering similar coverage options and pricing. However, Allstate often gets the edge in terms of customer service, with many customers praising their agents' responsiveness and friendliness.

Allstate vs. GEICO

GEICO is known for its competitive pricing, but Allstate often offers more comprehensive coverage options. Plus, Allstate's customer service consistently receives higher ratings than GEICO's.

Tips for Choosing the Right Allstate Insurance Auto Plan

Finding the right insurance plan can be a bit tricky, but with a little guidance, you'll be all set. Here are some tips to help you choose the perfect Allstate insurance auto plan:

- Assess Your Needs: Determine what coverage options are most important to you.

- Shop Around: Compare Allstate's rates with other providers to ensure you're getting the best deal.

- Ask About Discounts: Don't forget to inquire about available discounts to lower your premium.

- Read the Fine Print: Make sure you fully understand your policy's terms and conditions.

Frequently Asked Questions About Allstate Insurance Auto

Got questions? We've got answers. Here are some of the most frequently asked questions about Allstate insurance auto:

How Do I Get a Quote?

Getting a quote is easy. Simply visit Allstate's website or call their customer service hotline to get a personalized quote based on your needs.

What Happens If I Miss a Payment?

If you miss a payment, Allstate will typically give you a grace period to catch up. However, if the payment remains outstanding, your policy may be canceled.

Can I Change My Coverage Mid-Term?

Absolutely! You can adjust your coverage at any time by contacting Allstate's customer service team.

In conclusion, Allstate insurance auto is a solid choice for drivers looking for reliable, comprehensive coverage. With a wide range of options, competitive pricing, and excellent customer service, Allstate has earned its place as one of the top insurance providers in the U.S. So, what are you waiting for? Take the first step today and see how Allstate can protect your ride!

Don't forget to share your thoughts in the comments below or check out our other articles for more tips and insights. Stay safe out there, and happy driving!

Detail Author:

- Name : Rodrick Kris

- Username : nikolas79

- Email : lorena72@yahoo.com

- Birthdate : 2000-10-11

- Address : 48784 Hoeger Burg Apt. 204 Kingtown, PA 28309-5539

- Phone : 781.843.1263

- Company : Weimann Inc

- Job : Mold Maker

- Bio : Voluptatem quis dolor veritatis voluptate nostrum natus doloremque. Et quos consequatur quidem tempora eum et. Dolore voluptatum est odit consequatur eos.

Socials

instagram:

- url : https://instagram.com/velva.macejkovic

- username : velva.macejkovic

- bio : Placeat ut ratione enim quia. Dolorem ut quae praesentium eligendi ut dolor corrupti sit.

- followers : 6925

- following : 2214

facebook:

- url : https://facebook.com/velva2309

- username : velva2309

- bio : Sequi est voluptatibus cum rerum reprehenderit.

- followers : 5438

- following : 2061

twitter:

- url : https://twitter.com/vmacejkovic

- username : vmacejkovic

- bio : Ut hic blanditiis consequuntur enim magni modi nesciunt tenetur. Rerum asperiores ipsa in. Ducimus rerum vitae voluptatem quaerat quos.

- followers : 1542

- following : 1904