New York State Income Tax: A Comprehensive Guide To Understanding And Managing Your Finances

When it comes to taxes, New Yorkers know the drill – they’re complex, they’re unavoidable, and they’re essential to keeping the state running. But have you ever stopped to really understand how NY State Income Tax works? It’s not just about filing a form; it’s about making informed financial decisions that affect your wallet and future. Whether you’re a resident, a business owner, or someone planning to relocate, knowing the ins and outs of New York State Income Tax is crucial.

Let’s be real, taxes can feel like a maze of numbers and legal jargon. But don’t worry, we’ve got your back. In this article, we’ll break down everything you need to know about New York State Income Tax in a way that’s easy to understand and super useful. We’re here to help you navigate the system, save money where possible, and avoid costly mistakes.

From understanding the rates to exploring deductions and credits, we’ll cover all the angles so you’re fully prepared come tax season. Stick around, because by the end of this, you’ll be a pro at managing your NY State Income Tax. Trust us, your future self will thank you for it.

- 5movierulztips Your Ultimate Guide To The World Of Movie Streaming

- Sports Career Of Maria Taylor The Ultimate Journey Of A Multifaceted Athlete

Table of Contents

Overview of NY State Income Tax

Understanding New York State Income Tax Rates

Who Needs to File NY State Income Tax?

- Unveiling The World Of Vegamovieslink Your Ultimate Guide To Streaming Movies

- Sd Movies Point Marathi Download Your Ultimate Guide To Marathi Movies

Deductions and Credits: How to Lower Your Tax Bill

Important Deadlines to Remember

What Happens If You Miss the Deadline?

Tax Implications for Businesses in New York

Non-Residents and Part-Year Residents: What You Need to Know

Useful Resources for NY Taxpayers

Overview of NY State Income Tax

So, let’s start with the basics. New York State Income Tax is a tax levied by the state on the income earned by individuals, businesses, and other entities within its borders. It’s one of the main sources of revenue for the state government, helping fund essential services like education, healthcare, transportation, and public safety.

The tax system in New York is progressive, meaning the more you earn, the higher the percentage of your income you’ll pay in taxes. This ensures that those who can afford to contribute more do so, while lower-income residents are taxed at a lower rate. Makes sense, right?

Now, here’s where it gets interesting. New York also has specific rules for residents, non-residents, and part-year residents. Depending on your situation, you might be subject to different tax rates and filing requirements. We’ll dive deeper into this later, but for now, just know that understanding your residency status is key to navigating NY State Income Tax.

Why Does NY State Income Tax Matter?

Well, for starters, it directly impacts your take-home pay. Knowing how much you’ll owe or how much you might get back in refunds can help you plan your finances better. Plus, staying on top of your tax obligations ensures you avoid penalties and interest charges. No one wants to deal with that headache.

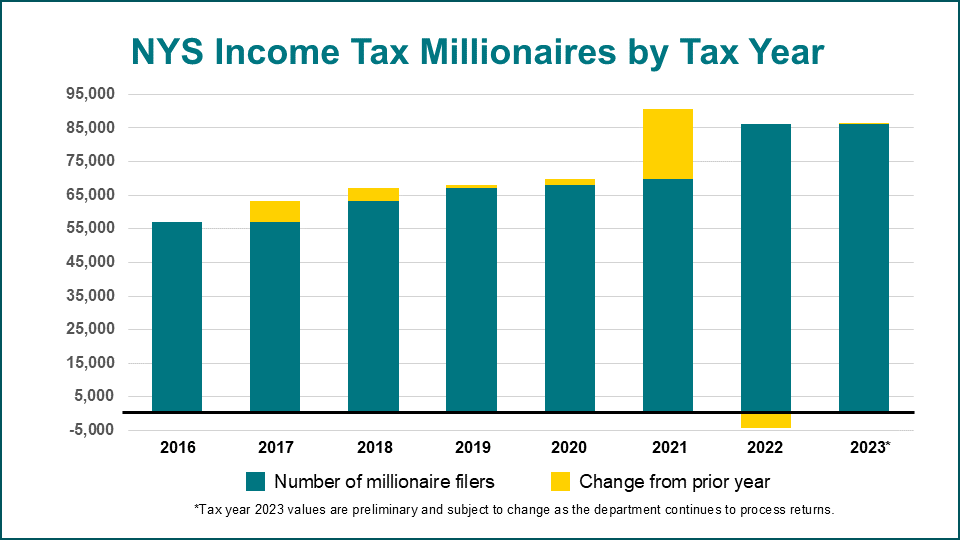

Understanding New York State Income Tax Rates

Alright, let’s talk numbers. As of the latest tax year, New York State Income Tax rates range from 4% to 10.90%. These rates apply to different income brackets, so the amount you pay depends on how much you earn. Here’s a quick breakdown:

- 4% for income up to $8,500

- 4.5% for income between $8,501 and $11,700

- 5.25% for income between $11,701 and $23,000

- 5.97% for income between $23,001 and $213,300

- 6.33% for income between $213,301 and $1,078,000

- 8.82% for income between $1,078,001 and $5,000,000

- 10.30% for income between $5,000,001 and $25,000,000

- 10.90% for income over $25,000,000

These rates are subject to change, so always check the latest updates from the New York State Department of Taxation and Finance. Remember, these are just state taxes; you’ll also need to factor in federal taxes and any local taxes if you live in a city like New York City.

How Are These Rates Calculated?

It’s all about your taxable income. Once you’ve deducted allowable expenses and credits from your total income, what’s left is your taxable income. This figure determines which tax bracket you fall into and, consequently, how much you’ll owe. Pretty straightforward, huh?

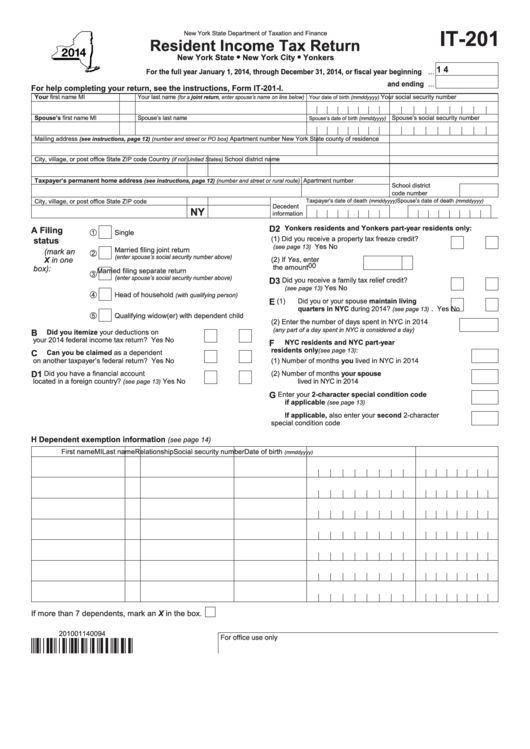

Who Needs to File NY State Income Tax?

Not everyone has to file a New York State Income Tax return, but it’s important to know if you’re required to. Generally, if you’re a resident of New York and have earned income, you’ll need to file. This includes wages, self-employment income, investment income, and more.

Even if you don’t owe any tax, you might still want to file to claim a refund. For example, if you had taxes withheld from your paycheck but ended up owing less than that amount, filing a return is the only way to get your money back.

Special Cases: Non-Residents and Part-Year Residents

If you’re not a full-time resident of New York but earned income in the state, you might still need to file a part-year or non-resident return. This applies to people who work in New York but live elsewhere or those who moved in or out of the state during the tax year.

Deductions and Credits: How to Lower Your Tax Bill

Who doesn’t love saving money? One of the best ways to reduce your NY State Income Tax is by taking advantage of deductions and credits. These are essentially reductions in the amount of tax you owe, and they can add up quickly.

Some common deductions include contributions to retirement accounts, certain business expenses, and medical expenses. Credits, on the other hand, directly reduce your tax liability dollar-for-dollar. Examples include the Child Tax Credit, Earned Income Tax Credit, and credits for education expenses.

Tips for Maximizing Deductions and Credits

Keep meticulous records of your expenses throughout the year. This will make it easier to claim deductions and credits when filing your return. Also, stay informed about any new or updated credits and deductions that might apply to your situation. The IRS and New York State websites are great resources for this.

Important Deadlines to Remember

Mark your calendars, folks. The deadline for filing NY State Income Tax is typically April 15th, the same as the federal deadline. If this date falls on a weekend or holiday, it might be extended by a day or two, so always double-check.

Missing the deadline can lead to penalties and interest on any unpaid taxes, so it’s crucial to file on time. If you need more time, you can request an extension, but keep in mind that this only gives you extra time to file, not to pay any taxes owed.

What Happens If You File Late?

If you fail to file by the deadline, you could face late filing penalties of up to 5% of the unpaid tax for each month your return is late, up to a maximum of 25%. On top of that, you’ll also owe interest on any unpaid taxes. Not exactly a fun situation to be in, right?

What Happens If You Miss the Deadline?

Let’s say you forgot to file or just couldn’t get it done in time. What now? As mentioned earlier, you’ll likely face penalties and interest charges. But here’s the good news – if you file and pay as soon as possible, you might be able to reduce or eliminate some of these penalties.

It’s always better to file a late return than not file at all. Even if you can’t pay the full amount owed, setting up a payment plan with the state can help you avoid further consequences.

How to Avoid Penalties

The best way to avoid penalties is to file and pay on time. If you’re unable to do so, communicate with the New York State Department of Taxation and Finance as soon as possible. They might offer installment agreements or other options to help you get back on track.

Tax Implications for Businesses in New York

Businesses operating in New York also have to contend with state income taxes. Depending on the type of business, the tax obligations can vary. For example, corporations are subject to a corporate income tax, while sole proprietors and partnerships may pay through their individual tax returns.

Businesses can also take advantage of various deductions and credits to lower their tax burden. These might include deductions for business expenses, research and development credits, and credits for hiring certain types of employees.

Staying Compliant as a Business Owner

Keeping accurate financial records and staying up-to-date with tax laws is crucial for any business. Consider hiring a tax professional or using tax software to ensure you’re meeting all your obligations and taking advantage of all available benefits.

Non-Residents and Part-Year Residents: What You Need to Know

If you’re not a full-time resident of New York but still earned income in the state, you’ll need to file a non-resident or part-year resident return. This applies to people who work in New York but live elsewhere or those who moved in or out of the state during the tax year.

Non-residents are generally taxed only on income earned within New York, while part-year residents may be taxed on both New York-source income and income earned elsewhere during the time they were residents of the state.

How to Determine Your Residency Status

Your residency status depends on factors like where you maintain a permanent home and how much time you spend in New York. If you’re unsure, consult a tax professional or refer to the guidelines provided by the New York State Department of Taxation and Finance.

Useful Resources for NY Taxpayers

There’s no shortage of resources available to help you navigate NY State Income Tax. Here are a few we recommend:

- New York State Department of Taxation and Finance Website

- IRS Website for Federal Tax Information

- Local Tax Preparation Services

- Tax Software like TurboTax or H&R Block

These resources can provide valuable information and tools to make the tax process smoother and less stressful.

Conclusion and Final Tips

There you have it – a comprehensive guide to understanding and managing New York State Income Tax. From knowing the rates to exploring deductions and credits, we’ve covered all the essentials to help you stay on top of your tax obligations.

Remember, knowledge is power when it comes to taxes. The more you understand about how the system works, the better equipped you’ll be to make smart financial decisions. So, take the time to educate yourself, keep good records, and don’t hesitate to seek professional help if needed.

And hey, don’t forget to share this article with your friends and family. Who knows, you might just help them out too. Happy tax season, and may your returns always be in your favor!

Detail Author:

- Name : Ms. Joyce Bins

- Username : hschuppe

- Email : eleanore.balistreri@yahoo.com

- Birthdate : 1990-05-23

- Address : 215 Mante Pass Suite 261 West Jaylinstad, VA 13610

- Phone : 1-678-443-7404

- Company : Cole-Murazik

- Job : Ceiling Tile Installer

- Bio : Non amet omnis laudantium deserunt aut aut. Quod dolorem omnis quo placeat vitae. Ut asperiores quos quibusdam eum ab ratione quo. Enim aut quo voluptatem neque molestias.

Socials

linkedin:

- url : https://linkedin.com/in/shanyklocko

- username : shanyklocko

- bio : Eos error odit est omnis.

- followers : 3317

- following : 1263

tiktok:

- url : https://tiktok.com/@sklocko

- username : sklocko

- bio : Nihil nihil qui sit ut. Eum nobis sunt quia pariatur eum harum praesentium.

- followers : 1282

- following : 1093